Understanding Private Health Insurance: What You Need to Know

Private health insurance plays a vital role in the American healthcare landscape, offering individuals and families access to medical services outside of government-run programs. With a wide variety of plans and coverage options, understanding what constitutes private health insurance, how it is subsidized, and what standards it must meet is crucial for making informed healthcare decisions.

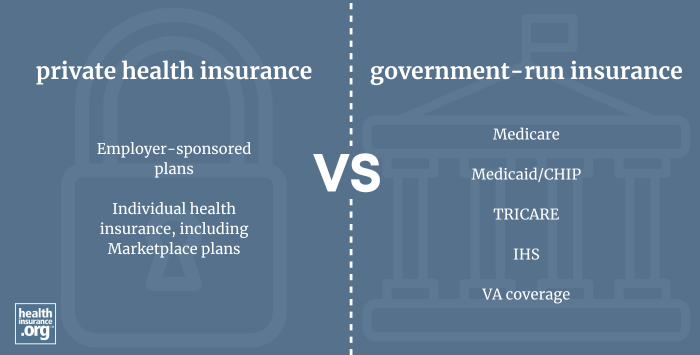

Private health insurance is primarily provided by private insurance companies or through employer-sponsored arrangements. Unlike government programs like Medicare, Medicaid, or CHIP, these plans are managed by private entities and are available to a significant portion of the population. Currently, just over half of Americans rely on private health coverage, which includes both employer-based and individually purchased plans.

Employer-sponsored plans are among the most common forms of private coverage, encompassing both self-insured plans, where the employer assumes the financial risk, and fully-insured plans, where an insurance company provides the coverage. Nearly 50% of Americans benefit from these employer plans. Additionally, about 6% purchase private insurance independently through the individual or family market, either on the health insurance exchanges or outside of them.

Beyond standard plans, there are various less-regulated private coverage options designed to serve as supplemental protection. These include short-term health plans, fixed indemnity plans, critical illness coverage, accident supplements, and dental and vision insurance. While these options are sold by private companies, they typically do not serve as comprehensive health coverage and are best used in conjunction with primary insurance to fill specific gaps or provide additional coverage for limited periods.

Is Private Health Insurance Subsidized by the Government?

Most private health coverage benefits from government support in some form. Employer-sponsored insurance is usually subsidized through tax benefits, as premiums paid by employees are often deducted pre-tax, reducing taxable income. According to projections by the Congressional Budget Office, federal subsidies for employer-sponsored health plans could reach approximately $3.7 trillion over a decade, primarily because these benefits are excluded from payroll and income taxes.

For individuals purchasing private insurance on the marketplace, the Affordable Care Act introduced premium subsidies and cost-sharing reductions, making coverage more affordable for many. These subsidies are designed to lower monthly premiums and out-of-pocket costs, substantially reducing the financial burden for enrollees. The same report estimates that federal spending on premium subsidies could total around $800 million over ten years. However, the government no longer funds cost-sharing reductions, which has led to higher overall costs for some consumers.

Not everyone qualifies for these subsidies. Those with higher incomes might not receive any assistance but can often deduct their insurance premiums on their tax returns. The American Rescue Plan temporarily expanded eligibility for premium assistance, extending subsidies through 2025, but future extensions depend on congressional action. Regardless, the option to deduct premiums remains available, providing some financial relief.

Do Private Health Insurance Plans Meet Minimum Standards?

Yes. Both federal and state regulations ensure that private major medical plans adhere to specific minimum standards. For example, the Affordable Care Act mandates that individual and small-group plans cover essential health benefits, including preventive services, emergency care, and maternity coverage. Large-group plans must provide minimum value, meaning they offer a level of coverage that meets certain cost-sharing criteria, or they risk penalties under the employer mandate.

Federal regulations also cap out-of-pocket expenses for in-network services—set at a maximum of $9,200 for a single individual in 2025—ensuring that consumers are protected from excessive costs. States further regulate health plans by establishing their own essential health benefits benchmarks, which set the baseline requirements for plans sold within their jurisdictions. Self-insured plans, however, are regulated by federal law.

Is Private Health Insurance Considered Minimum Essential Coverage?

Most private health plans qualify as minimum essential coverage, which is necessary to avoid penalties and meet legal standards. This includes employer-sponsored plans, ACA-compliant individual plans, and grandfathered or grandmothered policies. These plans are recognized as providing the comprehensive coverage required under the law.

Interesting:

However, some less regulated private options do not qualify. Short-term health plans, fixed-indemnity policies, critical illness insurance, accident supplements, and dental or vision-only plans are generally excluded from the minimum essential coverage category. Additionally, certain health-sharing ministries and direct primary care arrangements are not considered insurance under federal definitions, and thus do not meet the minimum standards.

Where Can You Purchase Private Health Insurance?

Individuals not eligible for employer-based or public programs can buy private health insurance through their state’s marketplace or exchange. These platforms facilitate access to plans that often include premium subsidies and cost-sharing reductions if income qualifies. Alternatively, individuals can purchase coverage directly from insurance companies; however, doing so generally disqualifies them from receiving federal subsidies. To benefit from subsidies later during tax filing, purchasing through the marketplace is essential.

Coverage can only be purchased during open enrollment periods or following qualifying life events, such as marriage, birth, or loss of other coverage. This applies whether buying through the marketplace or directly from an insurer, emphasizing the importance of timing when securing coverage.

What Types of Coverage Are Not Considered Private Health Insurance?

A significant portion of the population is covered by government programs like Medicare, Medicaid, CHIP, Indian Health Service, or VA health benefits. Many of these programs contract with private insurers to offer managed care plans, such as Medicaid managed care or Medicare Advantage plans. These arrangements are technically private plans but are funded and regulated by the government.

For example, as of 2021, nearly three-quarters of Medicaid enrollees were in private managed care plans, and over half of Medicare beneficiaries participate in private Medicare Advantage plans. Despite their private nature, these plans are financed and overseen by federal or state governments. Beneficiaries can also purchase supplemental private plans like Medigap or Medicare Part D, which are heavily regulated.

Is Private Health Insurance Expensive?

Costs for private health insurance vary widely. Employer-sponsored plans typically have a significant portion of premiums paid by employers, reducing out-of-pocket expenses for employees. On the other hand, marketplace plans’ prices depend mainly on income, age, and location. As of 2024, most enrollees in the health insurance exchanges receive substantial premium subsidies, with the average subsidy covering nearly $536 of monthly premiums—most pay less than full-price premiums of around $603.

For individuals who do not qualify for subsidies—usually those with higher incomes—costs can be substantial, especially for older adults or residents in areas with high premiums. Older applicants may be charged three times more than younger ones, and tobacco users often face higher premiums. This variation underscores the importance of exploring all available options and understanding subsidy eligibility.

Why Is It Called ‘Private’ Health Insurance?

The term “private” distinguishes these plans from government-funded programs. Offered by private insurers and employers, private health insurance is subject to regulation but remains independently operated, unlike public programs managed directly by government agencies. Despite this, many private plans must comply with federal and state standards to ensure they provide adequate coverage.

Related terms:

- individual health insurance

Related articles: