Balance billing can be a confusing aspect of health insurance, often leading to unexpected expenses for patients. It occurs when healthcare providers bill patients directly for the difference between what the insurer pays and the provider’s full charge. This practice can result in significant out-of-pocket costs, especially when dealing with out-of-network providers or emergency situations. As healthcare costs continue to rise, understanding how balance billing works and the protections in place has become increasingly important for consumers seeking transparency and financial protection within their health plans.

What is Balance Billing?

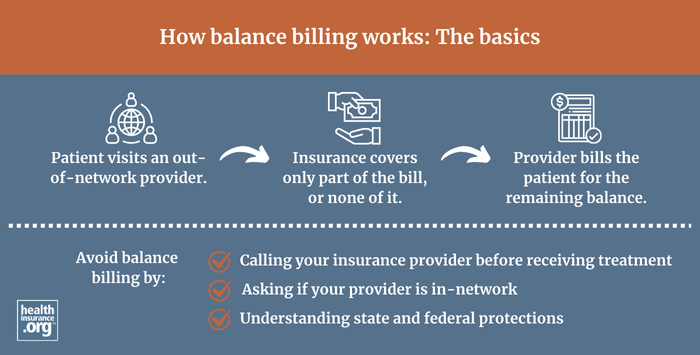

Balance billing happens when a healthcare provider charges a patient for the remaining balance after the insurance company has paid its portion. Typically, insurance companies negotiate discounted rates with in-network providers, and these providers agree to accept the insurance payment as full compensation, minus any copays, deductibles, or coinsurance owed by the patient. However, out-of-network providers often do not have such agreements, and they are legally permitted to bill the patient for the difference—referred to as the balance—between the provider’s full fee and the insurer’s approved amount. This practice results in the patient being responsible for the outstanding balance.

Some insurance plans, particularly Preferred Provider Organizations (PPOs) and Point of Service (POS) plans, do cover out-of-network care, but at higher costs. When out-of-network services are used, insurers pay based on their reasonable and customary rates. Patients then pay the difference if the provider’s charges exceed what the insurer reimburses. This is where balance billing becomes a concern, as providers can bill patients for the additional amount, which can sometimes amount to thousands of dollars.

Surprise Balance Billing: Federal Protections Introduced in 2022

The issue of surprise balance billing becomes particularly problematic when patients receive care at in-network facilities but are unknowingly treated by out-of-network providers. This can happen in emergency situations or when patients visit hospitals or clinics that have both in-network and out-of-network providers. In such cases, patients might receive a bill that they did not anticipate, often for substantial sums.

To address this unfair practice, federal legislation known as the No Surprises Act was enacted in 2022. This law was part of the larger Consolidated Appropriations Act, 2021, which Congress passed with broad bipartisan support and signed into law by President Trump in December 2020. The legislation aims to protect consumers from unexpected medical bills, especially in emergency scenarios or when receiving care at in-network facilities from out-of-network providers. The final rules for implementing the law were published in August 2022, and they have provided significant relief for insured individuals.

Interesting:

This law prohibits most surprise balance bills for services received from out-of-network providers under specific circumstances, such as emergencies or care at in-network facilities. It ensures that patients are protected by either the health plan’s maximum out-of-pocket limits or the ban on surprise billing itself. Although the legislation primarily addresses air ambulance charges, ground ambulance services have yet to be fully incorporated into these protections, leading to ongoing discussions and proposals for future legislation.

How the No Surprises Act Offers Consumer Safeguards

The protections introduced by the No Surprises Act are designed to prevent consumers from being financially burdened by unexpected bills when they have little control over the provider network. These protections took effect at the start of 2022, and enforcement is shared between federal and state authorities in most regions. The law applies to emergency care and situations where patients receive out-of-network services at in-network facilities, shielding them from surprise charges and ensuring transparent billing practices.

Additional guidance issued in 2023 clarified the scope of protections, reaffirming that patients are safeguarded from surprise balance bills and limiting their out-of-pocket expenses. While the legislation addressed some aspects of ambulance billing, it did not cover all types of ground ambulance services, which are often provided by local governments. As a result, some states have enacted their own rules to limit patient exposure to balance billing for ambulance services, and recommendations from advisory committees continue to shape future policies.

Despite ongoing legal challenges to the implementation of the law, the consumer protections remain in effect, offering vital financial safeguards for millions of Americans. For more details on how these protections work, you can explore the impact of AI on healthcare and how technological advances are shaping patient outcomes.

Related Terms

- Pre-authorization procedures and their role in managing healthcare costs.

Related Articles

- Four reasons to not delay enrolling in an ACA health plan until the last minute.

Footnotes

- Employer Health Benefits, 2023 Annual Survey, KFF, Oct. 18, 2023.

- Federal Ground Ambulance and Patient Billing Advisory Committee Recommendations, International Association of Fire Chiefs, Nov. 2023.

- Report on Ground Ambulance and Patient Billing, March 29, 2024.

- Legal Cases Challenging the No Surprises Act, Georgetown University Law School Health Care Litigation Tracker, Oct. 3, 2024.

- Implementation Status of the No Surprises Act, O’Neill Institute, Aug. 5, 2025.

Secure your health coverage today by discussing your options with licensed insurance professionals and understanding protections against unexpected charges that could otherwise lead to financial hardship.