Navigating the financial landscape of healthcare requires a comprehensive understanding of revenue cycle management (RCM). As the industry evolves with technological advancements and shifting payer policies, optimizing each step of the revenue cycle becomes essential for sustainable growth and improved patient outcomes. This guide explores the critical components of RCM, highlights emerging strategies, and provides insights into leveraging automation and analytics to maximize financial performance in healthcare settings.

What Is Revenue Cycle Management in Healthcare?

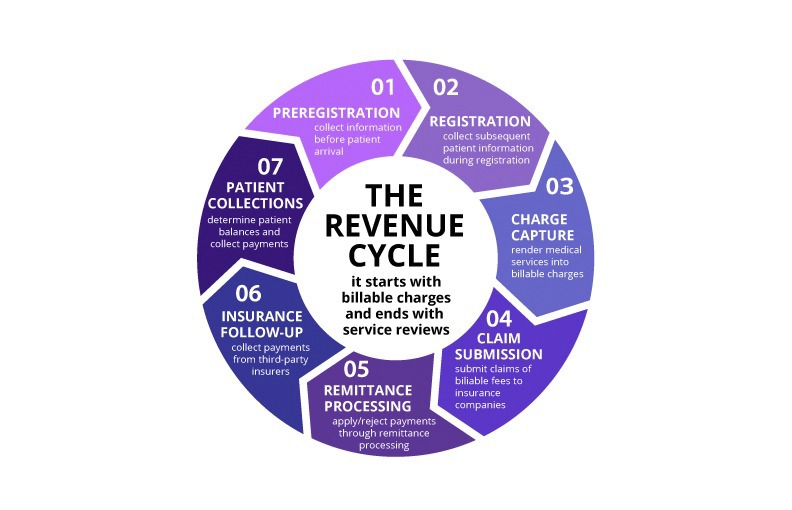

Revenue cycle management encompasses the entire process healthcare organizations use to track patient revenue from the moment of scheduling an appointment or hospital visit to the final payment of the bill. It begins when a patient first interacts with the healthcare provider and concludes once the provider receives full compensation for services rendered.

RCM extends beyond simple billing; it plays a vital role in maintaining the financial health of healthcare organizations, ensuring compliance with regulatory standards, and enhancing patient satisfaction. This interconnected process influences nearly every department, from clinical operations to administrative functions, making effective management crucial in today’s complex healthcare environment.

Why Is RCM So Critical Today?

- The shift toward value-based care models demands closer integration between clinical outcomes and revenue management.

- Interoperability mandates and advancements in artificial intelligence are transforming data exchange and processing within revenue cycles.

- Implementing analytics and automation significantly reduces manual errors, accelerates reimbursement timelines, and enhances the detection of financial risks.

- According to the National Institutes of Health, inefficiencies in revenue cycle processes cost U.S. healthcare providers approximately $262 billion annually, underscoring the urgent need for smarter, more agile strategies see NIH report.

Advantages of Effective Revenue Cycle Management

A robust RCM system not only keeps practices financially viable but also streamlines operations, improves patient experiences, and empowers staff to focus on delivering quality care. When financial processes operate smoothly, common pain points such as billing surprises and claim denials diminish, enabling providers to focus on growth and innovation.

Modern healthcare organizations are increasingly adopting AI-driven coding solutions, automated claims processing, and real-time denial analytics to replace manual workflows. As interoperability and value-based care models evolve, an optimized RCM framework becomes a strategic advantage for adapting to industry changes.

Implementing an efficient RCM can:

- Enhance patient satisfaction through transparent billing practices and prompt service delivery.

- Accelerate cash flow by ensuring claims are accurate and submitted promptly.

- Minimize claim rejections through proactive denial prevention and correction.

- Maintain regulatory compliance with streamlined audit processes and accurate documentation.

- Support organizational growth by reducing administrative burdens and freeing resources for strategic initiatives.

- Reduce staff workload by automating routine tasks, allowing clinical teams to dedicate more time to patient care.

Ultimately, improved financial health directly translates into better patient outcomes, staff morale, and organizational resilience.

Webinar: Healthcare Practice Revenue Cycle 101

Kathi Rennick, a recognized expert, reviews the essential processes and best practices for analyzing and optimizing your revenue cycle. This on-demand webinar offers valuable insights into integrating effective workflows and auditing strategies to ensure financial stability.

Duration: 49:56

Speaker: Kathi Rennick, CPC, CPMA, CPC-I, CHC, Director, LBMC Physician Business Solutions, LLC

Recorded: February 9, 2021

7 Critical Steps in Healthcare Revenue Cycle Management

Access a printable PDF for detailed strategies

Below is an overview of each stage, emphasizing recent innovations like automation, payer complexity, and data analytics to enhance accuracy and efficiency.

| Step | Purpose | Optimization Strategies |

| — | — | — |

| 1. Preregistration | Gather patient info, verify insurance coverage before appointments | Use clearinghouse integrations for real-time eligibility, digital intake forms for accuracy, and scripts to set payment expectations early |

| 2. Registration | Confirm demographic and insurance details, collect copays, and secure authorizations | Automate verification workflows, utilize electronic signatures and ID scanning, and track document completeness with audit trails |

| 3. Charge Capture | Record all billable services accurately | Implement EHR-integrated coding tools, automate charge entry, and regularly audit ancillary service coding |

| 4. Claim Submission | Send accurate claims to payers | Use AI-powered claim scrubbing, real-time rejection tracking, and automated claims routing via clearinghouses |

| 5. Remittance Processing | Review payments and denials | Automate remittance posting, flag anomalies through analytics, and conduct routine denial reviews |

| 6. Insurance Follow-Up | Address unpaid claims | Use denial analytics to prioritize follow-up, assign specific payer teams, and automate claim status tracking |

| 7. Patient Collections | Collect patient payments efficiently | Offer online payment options, automate statements, and send reminders via text/email |

Each phase benefits from smarter tools, real-time data, and patient-centered workflows, positioning practices to improve cash flow, reduce denials, and foster sustainable growth.

1. Preregistration

Preregistration is the foundation of a successful revenue cycle. This step involves capturing vital patient data, verifying insurance eligibility, and establishing financial expectations—often while the patient is still on the phone. Many practices now employ digital intake platforms and integrate with clearinghouses to facilitate real-time eligibility checks, reducing manual errors and accelerating validation processes.

During preregistration, staff should clearly communicate financial policies, including co-payments, deductibles, and cancellation procedures. This proactive approach sets the financial tone and minimizes confusion, which can lead to billing delays or collection issues later on. Ensuring a streamlined preregistration process is crucial for a strong revenue cycle start.

2. Registration

Accurate registration is critical, as it confirms patient details and insurance coverage before services are provided. Staff must verify contact information, insurance details, and authorization status during each visit. Many organizations now use electronic signature capture and ID scanning to automate data collection and verification.

Interesting:

Collecting co-payments upfront and confirming referrals or prior authorizations ensures smooth reimbursement. Missing documentation at this stage can lead to denied claims and financial penalties during audits. Utilizing integrated financial clearance tools can help staff track required documents and authorization statuses effectively.

Regularly reviewing and refining registration protocols ensures data accuracy and reduces downstream issues, saving time and resources.

3. Charge Capture

Charge capture involves documenting all billable procedures and services accurately. This can be automated through EHR systems that transfer documentation directly into billing modules or performed manually by staff. AI-assisted coding tools are increasingly used to identify incomplete or inconsistent documentation, reducing missed charges.

Ancillary services are often overlooked, leading to revenue loss. Regular charge reconciliation audits and the use of coding dashboards help maintain accuracy. To prevent missed charges, organizations should conduct periodic reviews and follow best practices for coding and documentation.

Expert consultation can help identify gaps or errors in charge capture, ensuring all billable activities are properly documented and billed.

4. Claim Submission

Once charges are documented, the next step is submitting claims to payers. Accuracy in coding diagnoses and procedures is essential, as mismatches or errors cause delays or denials. Claim scrubbing tools—powered by AI and predictive analytics—help identify potential issues before submission.

Claims are routed through clearinghouses, which act as intermediaries to ensure they reach the correct payer. Monitoring transmission reports and rejection notices allows billing teams to promptly correct errors, minimizing delays. Automating report reviews enhances response times and reduces revenue leakage.

Consulting with revenue cycle experts can improve claim accuracy and streamline the submission process, leading to faster reimbursements.

5. Remittance Processing

Received remittance advices detail the amounts paid, adjusted, or denied by payers. Proper review and posting of these payments are crucial to maintaining accurate accounts receivable. Allowables—contracted rates negotiated with insurers—must be verified to ensure appropriate reimbursement.

A common pitfall is “post and go,” where remittances are posted without review, risking missed errors. Advanced reporting tools now flag anomalies in real time, enabling proactive correction. Regular review of fee schedules ensures providers do not leave money on the table due to outdated rates.

Contractual and non-contractual write-offs are inevitable, but practices should identify and minimize avoidable adjustments by strengthening their remittance reconciliation processes.

6. Insurance Follow-Up

Tracking unpaid or underpaid claims is vital for maintaining cash flow. Aging reports and denial management tools help identify claims that need follow-up. Assigning dedicated payer teams, cross-training staff, and automating status updates improve collection efficiency.

Using payer-specific analytics and queue management ensures timely follow-up, reducing days in accounts receivable. Regular review of unresolved claims and appeals can identify systemic issues and improve recovery rates.

Engaging consultants or specialists in denial management can optimize follow-up strategies, minimizing revenue loss.

7. Patient Collections

Patient collections often present the greatest challenge. Collecting copayments and deductibles at the point of service reduces outstanding balances. Staff should be trained to communicate payment expectations clearly, supported by digital payment tools and self-service portals.

Automated statements and reminders via text or email accelerate patient payments and reduce aging accounts. Instituting a daily or weekly statement cycle ensures timely billing and cash flow. Mobile billing platforms enhance convenience, leading to higher collection rates.

Effective patient collection practices are essential to closing the revenue cycle loop and ensuring financial stability.

How LBMC Supports Healthcare Revenue Cycle Enhancement

When revenue cycle processes falter, the impact extends beyond finances—affecting staff morale, patient satisfaction, and operational efficiency. LBMC’s Healthcare Advisory team offers tailored support to identify weaknesses, reduce claim denials, and improve cash flow. Our expertise helps practices implement innovative solutions and streamline workflows aligned with industry best practices.

From process assessments to denial management and staff training, we assist healthcare providers across multiple locations—including Chattanooga, Memphis, Louisville, Nashville, Knoxville, and Charlotte—and provide remote consulting nationwide. Our goal is to help organizations optimize their revenue cycle, allowing clinicians to focus on what they do best: patient care.

Explore our revenue cycle management services to discover how we can help you accelerate payments and strengthen your financial foundation see our services.

FAQs on Healthcare Revenue Cycle Management

How does the revenue cycle process work in healthcare?

It spans from patient scheduling through final payment, encompassing seven core stages: preregistration, registration, charge capture, claim submission, remittance processing, insurance follow-up, and patient collections. Each step ensures timely and accurate reimbursement for services.

How is revenue cycle management different from medical billing?

While medical billing focuses primarily on submitting claims and receiving payments, RCM is a comprehensive strategy that integrates clinical documentation, front-end registration, coding, collections, and financial reporting to optimize revenue.

What common challenges do healthcare organizations face with revenue cycle management?

Recurring issues include claim denials, delays in insurance follow-up, incomplete charge capture, and slow patient collections. Outdated technology, staffing shortages, and evolving payer policies further complicate effective management.

What key performance indicators (KPIs) should be tracked?

Important metrics include days in accounts receivable (A/R), denial rates, clean claim percentages, net collection rate, and on-the-spot patient collection rate. Monitoring these KPIs helps identify bottlenecks and measure improvement efforts.

How can automation and AI transform revenue cycle operations?

Automation reduces manual errors and enhances efficiency, while AI tools can flag problematic coding, predict denials, and prioritize claims for resolution. Together, they enable faster, more accurate reimbursements with less administrative burden.

What services does LBMC offer to improve healthcare revenue cycles?

LBMC provides comprehensive support, including process assessments, denial management, charge audits, and staff training. Our goal is to help healthcare providers streamline operations and enhance financial performance see how we’re bridging the gap with innovative tech.